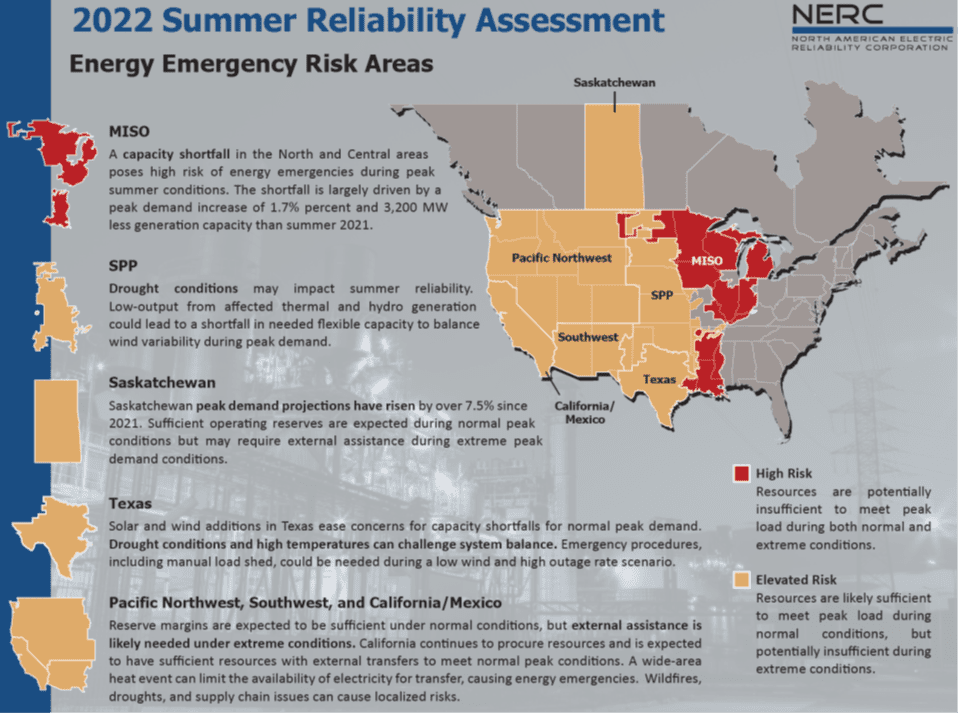

For those who thought the California (2020) and Texas (2021) blackouts were outliers, the North American Electric Reliability Corporation’s (NERC) sobering report, released on May 18, 2022, put that notion to rest.

In its summer reliability assessment, NERC identified several areas of the country likely to experience an elevated or high risk of load shed – a fancy term for blackout. The identified areas represent all, or parts, of 27 states, including the hydro-dominated Pacific Northwest.

At the same time, the Federal Energy Regulatory Committee (FERC) recently issued a series of questions to the grid operators throughout the United States, probing them for information about how they are evolving their market rules to ensure reliability during the energy transition.

The NERC report, coupled with a growing concern from FERC commissioners, has put a spotlight on resource adequacy, system flexibility, and resilience. The conversation appears to be shifting from “deploy, deploy, deploy,” which is U.S. Department of Energy’s Secretary Granholm’s mantra about getting renewables onto the grid, to “How do we maintain reliability during the transition?”

For the hydropower industry, this is a welcome change, as the vast array of energy services that conventional hydro and pumped storage hydro provide will be in greater focus as new market designs are debated and implemented.

NERC’S SOBERING 2022 SUMMER ASSESSMENT

NERC’s 2022 summer reliability assessment is striking in how broad the areas of concern are. These elevated or high-risk areas include the Electric Reliability Council of Texas (ERCOT), most of the West Coast – including California Independent System Operator (CAISO), and Midcontinent Independent System Operator (MISO) in the middle of the United States.

Some of these areas have robust competitive markets while others are vertically integrated. CAISO has a resource adequacy construct while ERCOT has no capacity market at all. The highest risk appears to be in the MISO area where there is a hybrid market – a regional market with integrated utilities.

The North American Electric Reliability Corporation identified many causes of the elevated risk of load sheds, including:

- A capacity shortfall in the MISO area caused by increased demand, generator retirements, and a transmission line out of service

- A rapidly changing resource mix, from thermal resources to wind and solar

- Drought conditions in the West, which will lower the hydro output and includes the hydro imports from the Pacific Northwest into CAISO

- A delay in new generator interconnections due to supply chain issues and a clogged interconnection queue, among other factors.

“Extreme doesn’t mean rare,” said John Moura, the Director of Reliability Assessment and Performance Analysis at NERC, while explaining that utilities can no longer rely on normal forecasts. Weather continues to be a concern as wider swaths of the country face deeper droughts and elevated temperatures, making it more likely that all areas of the United States may experience the same extreme weather.

When this happens there is limited ability for neighbors to help neighbors, as is common when one grid relies on another for imports and firm energy.

FERC SENDS QUESTIONS TO RTOs ABOUT MARKET RULES

While speaking at the National Hydropower Association’s Waterpower Week in Washington policy conference on April 6, 2022, FERC Chairman Richard Glick expressed hope that the Commission would act soon on ensuring that resources are compensated for flexibility.

Last month, FERC took a modest step in this effort by issuing an order directing reports from the six Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs) requesting more granular information on how their markets are adapting to evolving system needs.

Specifically, FERC is asking the operators to provide:

- Information on current system needs given changing resource and load profiles

- How each RTO/ISO anticipates these needs to change over the next five and ten years

- How the RTO/ISO is planning to reform its energy and ancillary service markets to meet the needs over that timeframe

- Information on other capacity and resource adequacy reforms that would help meet changing system needs.

Given that hydropower is the largest source of clean flexibility on the grid, and that organized markets have largely not valued attributes of flexible generators, the National Hydropower Association will continue pressing FERC and the RTOs to evolve their rules to changing system needs.

In March of 2022, NHA member organizations and electric power experts identified several potential avenues for markets to better value firmness and flexibility, during a NHA Markets Committee symposium. NHA invited national power experts, regulators, and consultants to provide their thoughts on solving these issues with an eye toward what that means for hydropower and pumped storage. Learn more about the topics of the symposium by reading this POWERHOUSE article.