During the lame duck of last Congress, Senators Maria Cantwell (D-WA), Lisa Murkowski (R-AK), Debbie Stabenow (D-MI), and Dan Sullivan (R-AK) introduced legislation that would establish a new 30% investment tax credit (ITC) to incentivize environmental enhancements and dam safety improvements at existing hydropower facilities.

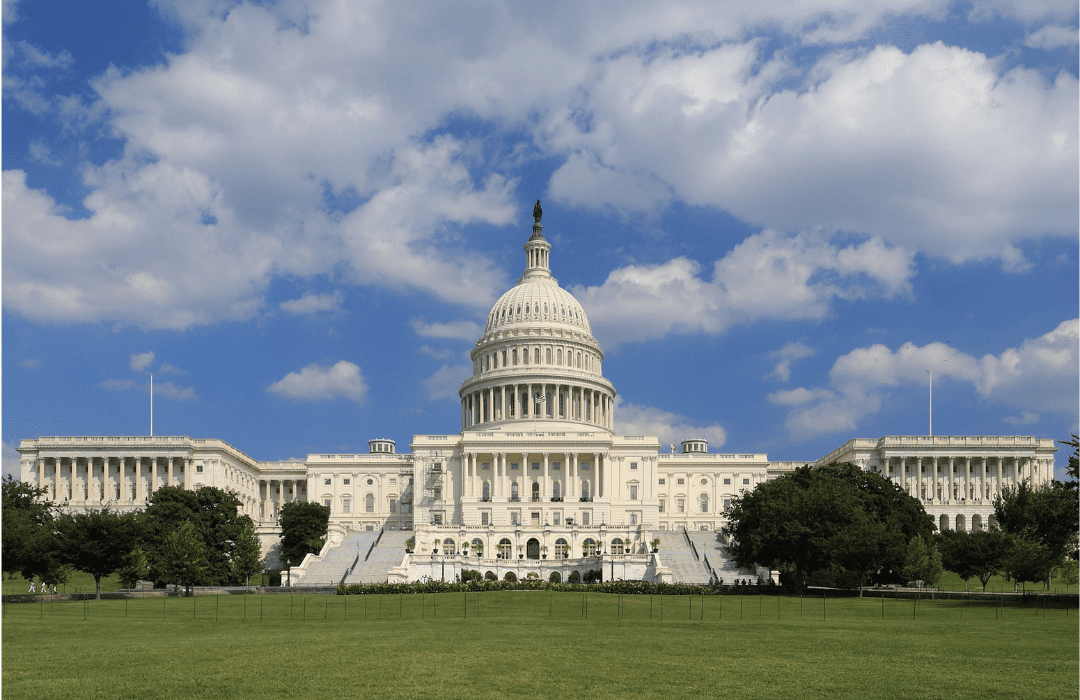

While NHA expects the Maintaining and Enhancing Hydroelectricity and River Restoration Act to be re-introduced with broad bipartisan support this fall, readers should contact their U.S. Senators and Representatives NOW to help advance this bill through the legislative process.

Improvements eligible for the 30% ITC include:

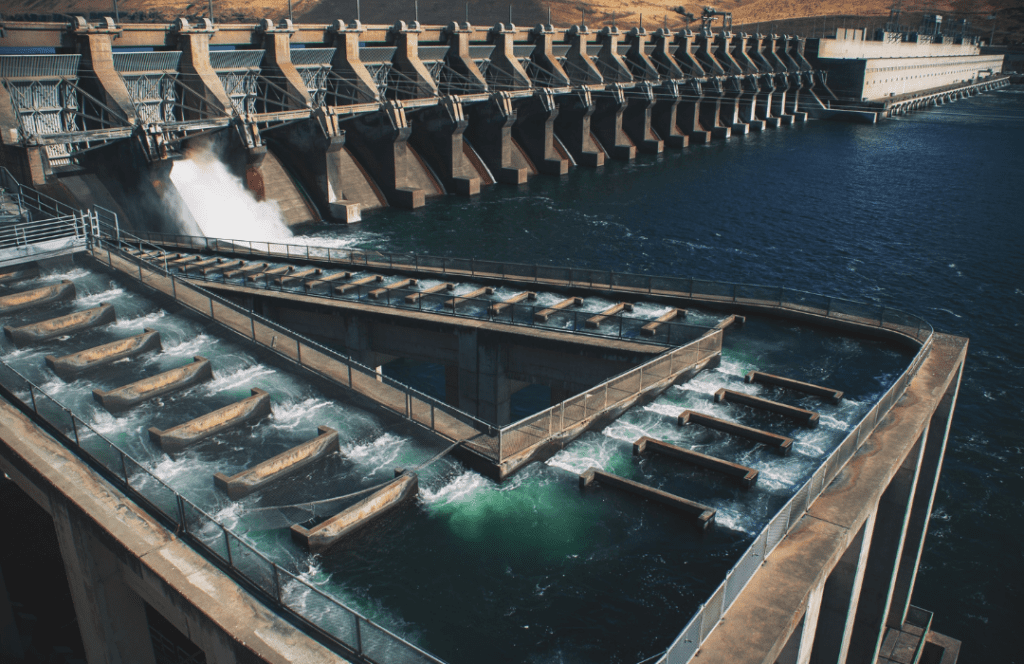

- Adding or improving fish passage.

- Maintaining or improving water quality.

- Upgrading or replacing floodgates and spillways.

- Managing river sediments to improve habitat.

- Improving public use of, and access to, public waterways impacted by existing dams.

- Removing an obsolete river obstruction.

By incentivizing environmental upgrades and retrofits, the Maintaining and Enhancing Hydroelectricity and River Restoration Act ensures that the existing hydropower fleet can continue to provide flexible, carbon-free energy generation to millions of homes and businesses in the U.S.

THE CHALLENGE

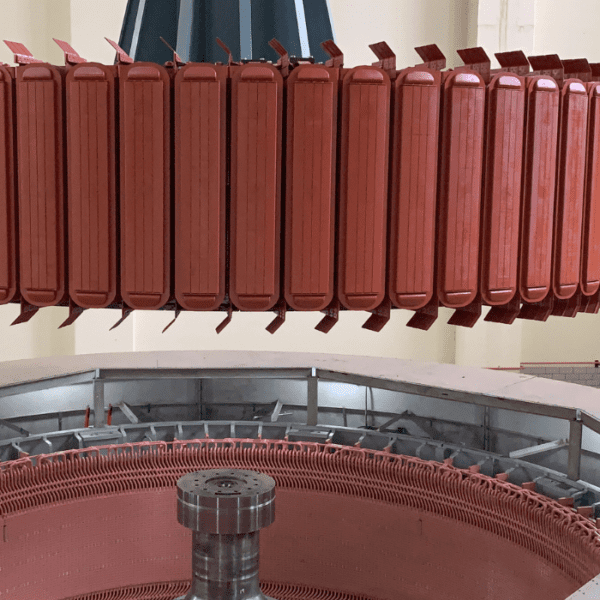

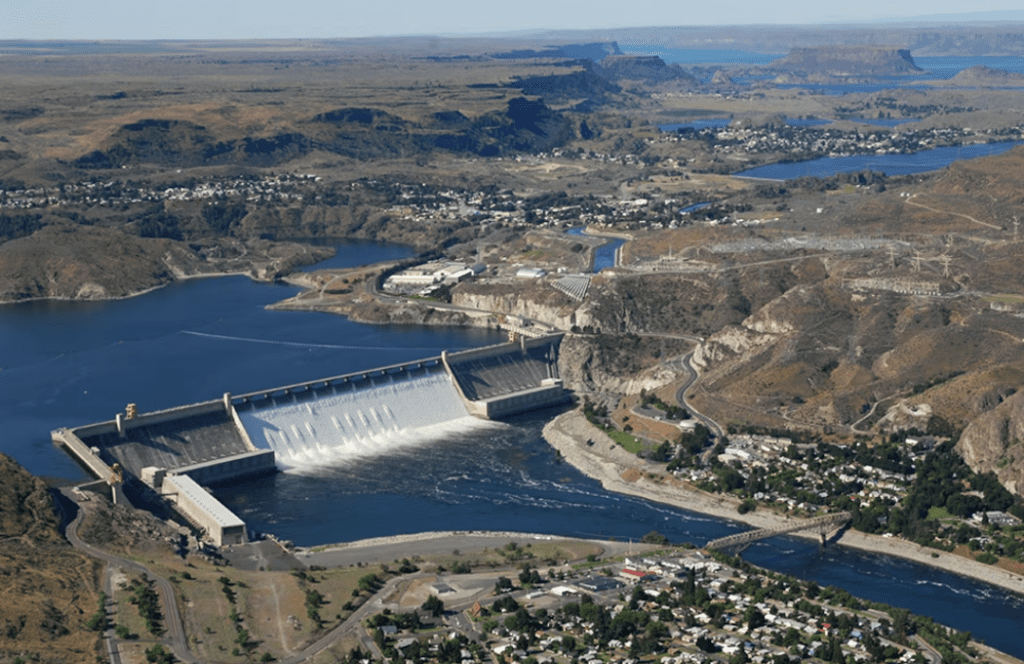

While the Inflation Reduction Act (IRA) created tax credits for new hydropower and pumped storage projects, it failed to address the maintenance needs of our nation’s existing hydropower fleet, which provides an impressive 102 GW of clean, reliable, dispatchable electricity to the grid. To compete equitably with other non-emitting energy resources, hydropower needs tax parity; without it, hydropower is at a disadvantage and could fall behind other renewable energy sources.

Furthermore, the U.S. hydropower fleet is aging; the average hydropower project in the U.S. is more than 60 years old, and upgrading the existing fleet to comply with modern design standards will require significant investment. A lack of tax support leaves many asset owners unable to finance these upgrades and at risk of license surrender. In fact, one-third of hydropower owners are actively considering surrendering their licenses and decommissioning their facilities. Without tax incentives to help hydropower facilities fulfill federal safety and environmental regulations, the more than 500 facilities up for relicensing between now and 2035 may retire or be forced to recoup the cost through higher electricity prices.

Importantly, hydropower fills in energy gaps for intermittent renewable energy sources, like wind and solar, and allows for greater integration of these resources onto the power grid. Therefore, these 17 GW of carbon-free energy are an essential part of a comprehensive climate solution. To protect existing hydropower assets and in turn, our nation’s electric grid, we must equip the hydropower industry with the financial tools and support required to make necessary environmental upgrades at their facilities. This is why the Maintaining and Enhancing Hydroelectricity and River Restoration Act is critical to the hydropower industry and must be enacted into law.

THE SOLUTION

The Maintaining and Enhancing Hydroelectricity and River Restoration Act creates a new federal tax incentive to encourage environmental improvements and dam safety upgrades at at existing hydropower facilities. This bill leverages the federal tax code by providing a 30% ITC to spur investments in our nation’s existing hydropower fleet. Eligible investments include adding fish-friendly turbines or other fish passage infrastructure, managing river sediment to improve habitat, upgrading or replacing floodgates and spillways, maintaining and improving water quality, removing obsolete river obstructions, and improving public use of and access to public waterways impacted by existing dams.

In addition, this legislation includes an elective pay option, which allows organizations exempt from federal income tax (state or local government, the Tennessee Valley Authority, or any Alaska Native Corporation) to take advantage of the tax credit as a direct payment from the Internal Revenue Service (IRS). Elective pay allows for applicable entities, like many NHA members who are public utilities and electricity co-ops, to take advantage of the energy credits by receiving a lump sum payment for the value of the credit as if they had been eligible for the credit to begin with.

If you have questions regarding elective pay and transferability, please refer to this explanation from the White House, or this FAQ from the IRS.

WHAT COMES NEXT?

With the bill’s expected reintroduction later this year, it is important that the hydropower industry makes its voice heard now! YOU are the hydropower industry’s greatest asset. Lawmakers listen to constituents first; one phone call to a Congressional office can make all the difference in whether this bill advances or not.

While discussions surrounding the year-end tax package continue to progress into late summer and early fall, it is critical that the hydropower industry advocates and continues to push for this common-sense tax credit, which will preserve hydropower as an important form of clean, baseload renewable.

Reach out to your U.S. Senators and Representatives to express your support for the Maintaining and Enhancing Hydroelectricity and River Restoration Act and ensure that hydropower isn’t left out of the conversation.

Questions on how to reach out to legislators? It’s easier than you may think!

- To find your U.S. Senators, click here. To find your U.S. Representative, click here.

- If you are calling, the office number can be found on the homepage of your legislator’s website.

- If you are emailing staff, please utilize this tool to find the energy staffer for your U.S. Senators, and this tool to find the energy staffer for your U.S. Representative.

- Ask the legislator to Co-sponsor and vote YES on the Maintaining and Enhancing Hydroelectricity and River Restoration Act.

- Offer to connect the office with Matthew Allen (matthew@hydro.org) and Brittney May (brittney@hydro.org) for any further questions or clarifications.

You can also invite a lawmaker to visit your facility. Conducting a site visit or tour with legislators or their staff is another way to elevate hydropower and present the issue in a tangible way (and offer the solution – to support our bill!) Read this POWERHOUSE article to find out how to invite lawmakers on a facility tour.

If you have any further questions, reach out to Matthew Allen, Director of Legislative Affairs, matthew@hydro.org or Brittney May, Legislative Affairs Manager, brittney@hydro.org.